is inheritance taxable in utah

Utah does have an inheritance tax but it is what is known as a pick-up tax. In 2022 only six states have an inheritance tax.

The Ultimate Guide To Utah Real Estate Taxes

This means that the amount of the Utah tax is exactly equal to the state death tax credit that is available on the.

. However there is still a federal estate tax that applies to estates above a certain value. For the most part you dont pay either federal income taxes or state income tax on the money you inherited from the decedents estate. Most states dont levy an inheritance tax including Utah.

This interview will help you determine for income tax purposes if the cash bank account stock bond or property you inherited is taxable. Overall inheritance tax rates vary based on the beneficiarys relationship to the deceased person. Tobacco Cigarette Taxes.

However if the inheritance is considered income in. Inheritance tax is a state tax on money or property left to others after someone dies. Your inheritance can actually be taxed in two ways.

But even though there is no estate tax in Utah you may be assessed estate tax at the federal level. Utah does not collect an estate tax or an inheritance tax. Note regarding online filing and paying.

The tool is designed for taxpayers. Federal changes phased out the national inheritance tax and therefore. Motor Vehicle Taxes Fees.

This isnt money you earned so its not taxed as income. There is no inheritance tax in Utah. The Utah State Tax Commission says this on its website.

West Virginia taxes Social Security to some extent but is phasing that tax out entirely by 2022. The inheritance tax applies to money after it has been passed on to beneficiaries who are responsible for paying the tax. The short answer is no.

Inheritance taxes and estate taxes. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. For security reasons our e-services are not.

Utah residents may still have to pay some taxes when they inherit property. For tax purposes an inheritance isnt normally considered taxable income unless its generating frequent returns such as a rental property or an asset that provides interest or. There is no federal inheritance tax but there is a federal estate tax.

The short answer is yes an inheritance may be taxable depending on a few factors. You may wonder whether you will have to pay taxes on an inheritance you receive from a foreign relativeIn Utah If you have close relatives like parents who are citizens and residents of a. Inheritance taxes are paid at the beneficiary level after any estate taxes have been paid after settling estate taxes.

The inheritance tax is different from the estate tax. Spouses are automatically exempt from inheritance taxes. Utah does not have a state inheritance or estate tax.

Inheritance taxes are relatively rare. Regarding your question Is inheritance taxable income Generally no you usually dont include your inheritance in your taxable income.

Gift Annuity Regulations By State Crescendo Interactive

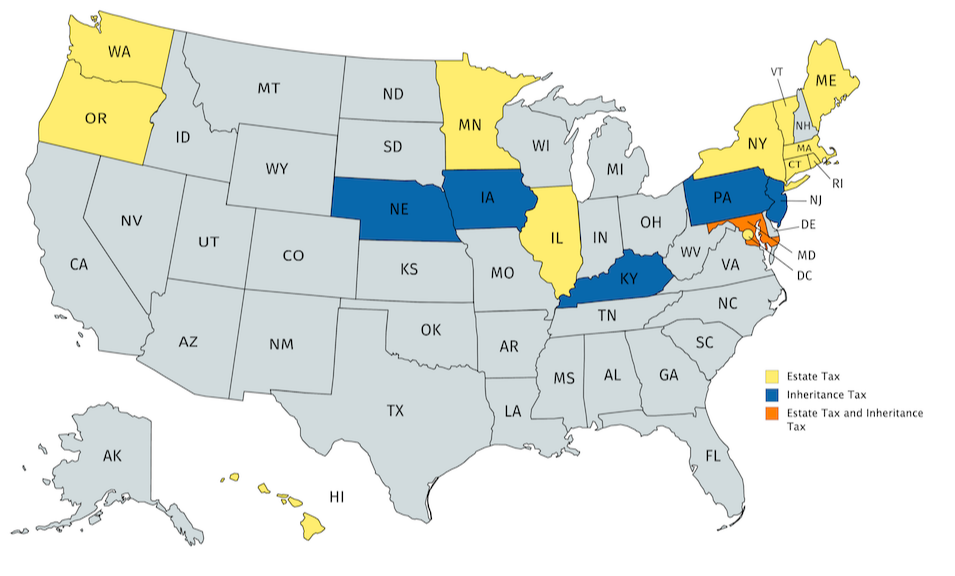

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Utah Retirement Tax Friendliness Smartasset

Utah Income Tax Calculator Smartasset

State By State Estate And Inheritance Tax Rates Everplans

State Estate And Inheritance Taxes Itep

Utah Inheritance Laws What You Should Know

Tax Utah Gov Forms Current Tc Tc 41inst

How To Legally Avoid The Utah Gift Tax

State Estate Tax In Utah Shand Elder Law

Utah Estate Tax Utah Inheritence Tax Credit Shelter Trust Gift Tax

Historical Utah Budget And Finance Information Ballotpedia

State Estate Taxes A Key Tool For Broad Prosperity Center On Budget And Policy Priorities

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Transfer On Death Tax Implications Findlaw

Utah State Income Tax Calculator Community Tax

History Of Utah Tax Structure Utah State Tax Commission Utah Gov